Your Rights, Your Pay: Understanding DOLE Holiday Pay Rules for Chinese New Year

The Chinese New Year is more than just a festive occasion—it’s also an opportunity for employees in the Philippines to claim what they rightfully deserve under the law.

The Department of Labor and Employment (DOLE) ensures workers are compensated fairly, even during special non-working holidays like this. Knowing your benefits and rights can empower you to make informed decisions and hold employers accountable.

Let’s unpack what you need to know, presented in a simple, engaging, and relatable way.

Why Holiday Pay Matters

Imagine working hard all year, only to miss out on proper compensation when it matters most.

DOLE’s holiday pay rules aren’t just numbers—they’re a reflection of respect for your work and dedication.

By understanding these policies, you ensure your value is acknowledged, even on special occasions.

Who Benefits From Holiday Pay Rules?

DOLE’s guidelines cover most workers in the private sector, but exceptions exist:

- Eligible Employees: Anyone who worked or was on leave with pay on the day before the holiday.

- Exceptions: Government employees, freelance workers, and independent contractors may not be covered.

- Always check your employment contract to clarify your status.

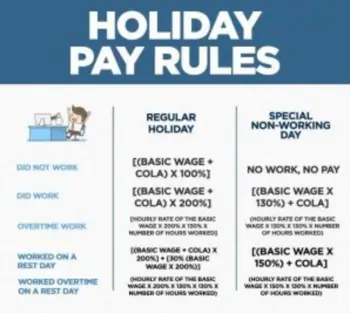

How Much Should You Get Paid?

The computation depends on whether you work on the holiday or take the day off. Let’s break it down:

If You Don’t Work:

You’re still entitled to 130% of your daily wage.

- Example: If your daily rate is ₱1,000, your holiday pay is ₱1,300.

If You Work:

You earn more because you worked during a special day. The formula: (Daily Rate x 1.30) + (Hourly Rate x Hours Worked x 1.30)

- Example: ₱1,000 x 1.30 + (₱125 x 8 x 1.30) = ₱2,600.

Overtime Work?

If you extend your hours, you’re entitled to an extra 30% premium: Hourly Rate x Overtime Hours x 1.69

- Example: ₱125 x 2 x 1.69 = ₱422.50.

Worked on a Rest Day?

Your hard work pays off with even higher rates: Daily Rate x 1.50 + (Hourly Rate x Hours Worked x 1.50)

- Example: ₱1,000 x 1.50 + (₱125 x 8 x 1.50) = ₱3,000.

Common Missteps to Watch For

- “No Work, No Pay” Myth: If you’re qualified, even staying home should earn you 130% of your wage.

- Confusion Over Overtime Rates: Always compute correctly; don’t let mistakes go unchecked.

- Missed Rest Day Compensation: Working on a rest day during a holiday? Your pay multiplies significantly.

Where to Seek Help

Sometimes, you might face challenges in claiming your rightful benefits. Here’s where to turn:

- DOLE Hotline: Dial 1349 for immediate assistance.

- Bureau of Working Conditions (BWC): File complaints if your employer violates rules.

- Labor Unions: Your allies in advocating for your rights.

Why Employers Should Comply

For employers, adhering to DOLE rules isn’t just about avoiding penalties; it’s about fostering trust. When workers feel valued, morale and productivity skyrocket—a win-win for everyone.

Empower Yourself Today

Your labor is worth more than a paycheck—it’s the backbone of the economy. Ensuring you receive fair compensation during holidays like the Chinese New Year isn’t just a legal right; it’s a sign of respect for your contribution.

Don’t leave your benefits on the table. This Chinese New Year, arm yourself with knowledge and claim what’s rightfully yours. Celebrate with confidence, knowing you’ve secured your fair share.

Remember: Staying informed is your best defense against missed opportunities.

Share this article with your colleagues and let’s make sure everyone is in the know! (Kamarites)